Online Sales. An FNB case study and some thoughts about the future...

“The great thing in the world is not so much where we stand, as in what direction we are moving.” -- Oliver Wendell Holmes

Writing this post has taken a long time (and it’s a long post). It’s one of those opinion pieces that moves dangerously between industry comment and personal insight. Add to that a healthy dose of consumer sceptism for banks in general, and you have the ingredients for a tricky piece of writing.

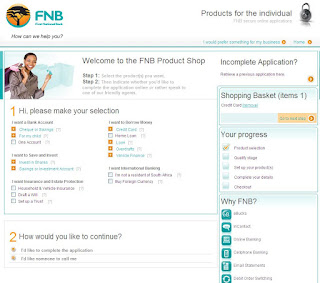

The stuff I’d like to share with you today is around the new online sales platform project at FNB – of which I had some intimate involvement. The project was internally labelled SSA (Single Sales Application), with the word “single” being the operative part. To you, it would just be: getting a bank product online. But getting behind the scenes of what actually changed in this version unravels the bank’s fascinating attempt to push the online sales experience into the new web world.

Current situation for financial applications in the online space? Long, boring, uncreative, repetitive forms with unfriendly language and often ever more work to do post-application than in-application.

What if a bank could produce one sales engine, speaking one customer-centric language, with one design, one set of verification documents and one form to fill in – for any product? Pah! You should have done that years ago, you say. Perhaps.

But you then highlight the thing financial institutes battle with the most with these days. It’s not overcoming legacy, or thinking innovatively about problems... It’s the sky high expectations of the modern Internet user - and meeting those expectations within reasonable time frames across multiple channels (from online, to telephone, to branch, to delivery).

When you buy products online with Amazon, the iTunes Store or even local players like Kalahari, you’re treated to a remarkably simple, intuitive and cunningly cross-sold experience. One click buy. Add to basket. People who like this also liked. Mature and well implemented experiences.

Whether financial institutions like it or not - that experience sets the standard of expectations for customers in the online space.

I could spend 1000 words explaining how process is important and FAIS this, compliance that all rolls together to prevent financial companies from really breaking the mould. But I won’t. Because that’s not the point. And customers don’t care. They want a sales experience that performs alongside the benchmarks, not behind them.

It was with this slightly cavalier attitude that the bank approached the online sales project. Some personal thoughts and insights follow.

Leads, more leads and applications

Let’s start off with the difference between a lead and a sales application, fundamentally different behaviours yet often confused. There are two big factors in play here:

Give us options. South Africa is a young Internet audience, just starting to grow up and really use and trust online services. Some of us might want an automated sales experience. Others don’t have the confidence to proceed from the loneliness of their couch. Always provide a “warm body backup” - a quick call back from a friendly voice goes a long way in this space.

And while you’re doing that? Provide save points and exit points for any level of frustration that may occur. Sometimes we get bored. Sometimes we run out of time. Sometimes our browser crashes. Catch the drop offs wherever possible, or fall victim to a nasty bounce rate and very little explanation as to why!

Never underestimate the power of a lead. If you’ve got a powerful call centre infrastructure and a simple product that escapes reams of compliance paperwork? There’s no reason not to just use a lead form – the local insurance industry is a shining example of how this works.

You can’t beat efficiency. And until the Internet can mimic or improve that experience – don’t bother. But what if you can improve that experience? What if you can create the simple, intuitive, retail interface that customers have come to expect?

Delving behind the scenes of the platform, here are a couple of points where I think FNB is moving in the right direction (and hopefully ahead of the curve)

As many products as you like. At the same time.

The first release of the sales engine opens up Credit Cards, Cheque Accounts, Investment Products and Share Investing Products into the new experience (all other products exist, just in singular application forms).

Believe it or not (and some don’t!) financial products often require vastly different data sets. Not only is your challenge to keep this data down to a minimum but also to only ask for it once. There is nothing more frustrating to a digital citizen than having to fill out the same form twice. Banks can take one to the chin here – they haven’t been too good at that in the past.

So now, you’re allowed to select as many products as you like, and provided one of them is in the above list, you’ll be treated to the new experience. Total screens to get through? Four screens and a couple of pop ups. Total times you’ll have to fill in that info? Once.

That’s STILL more complicated than Amazon. But let’s be fair – giving you R10,000 credit is a whole different ball park to ordering that sweet-smelling air freshener and “What to Expect When Expecting” combo deal.

Some stats from the first month or two reveal usage of this “multi-product” function is on the up. There have been instances of customers selecting up to 14 products at a time (go big or go home?) and it’s been amazing to watch, without any real promotion, 1 in 5 orders on average go through with more than one product attached. The basic human need is for options in the face of complexity. Branches have been servicing this need for a long time. Now the online space can chip in.

All power to the customer in the retail relationship.

There were two big customer experience gaps that I felt where missing in the online financial sales game. Firstly, the whole “add to basket” experience. A lot of confusion, in my opinion, is caused by the complexity of bank products and sales processes.

Sign this. Now this. Now that. Show me this. Oh, you’re missing THAT? Don’t you want this extra? OK! Well sign this. Now that.

You get the point.

If you want a product, or a bank wants to suggest an additional product to you (again, let’s be realistic, banks WANT to cross sell, doesn’t everyone?)... You should be able to get it in one click. End of story.

And then once you’ve built this little basket of financial goodness, you should be able to pull, push, prod and tweak those products as much, or as little as you like.

There is such amazing embedded value in these bank products that no-one knows about. I learnt the other day that in certain cases, I can by an LCD TV with my Platinum Credit Card, walk out the store, drop it – and the thing is fully insured. Giving power back to the customer in terms of setting up his product options and added values goes a long way to getting this message out.

Give it to me quickly. And don’t make me walk into a branch if I don’t want to.

There were a lot of creative phrases tossed around while dreaming up the vision for the sales engine. The one that stuck with me the most was “banking from the comfort of your couch”. It’s nothing new, although I’m constantly surprised that customers don’t know it’s available. Most of FNB’s main products have had courier delivery options for some years now. It really comes down to how you sell it and who actually wants it.

But before the courier comes into play – the speed of your purchase experience holds the key. Here’s how I (a slightly melodramatic marketer to be fair) do the math:

I exaggerate a little for effect! But it’s a great segway to one of the stats I am proudest to report. It takes about 9 minutes and 30 seconds for the average customer to get from the Product Shop to the Thank You screen.

Call banks old fashioned. Call ‘em inefficient. I think 9 minutes is one helluva achievement. Something I don’t mind yelling from the rooftops.

I could go on for a while, but just wanted to take you guys through some quick insights into step one of the long and involved digital sales journey that the bank has started.

Drop by. Give it a go! Try out the courier option. Better than that? Let me know what you think. It’s becoming increasingly important to involve customers in the product dev cycle. A lesson any web company can give to their bricks-and-mortar brethren. Let’s live it.

The platform been live for a couple of months now, and there are just one or two small issues being ironed out. Mostly around people that have been old customers of FNB and still exist on the database. Trickier issue than you may imagine. How can a bank be sure the YOU that had that Bob account 15 years ago is the same YOU sitting behind the computer? Rather be safe than sorry, eh?

A project of this size (and it’s only going to get bigger as the platform takes on “lending” products like Homeloans and Personal Loans) is never one person’s project. From the online teams to the mainframe wizards, the testers, the product owners, the designers, the coders, the devs, the project managers and everyone who stuck their nose in with a good idea – it’s been an honour. Hope the customers out there feel the same way...

Writing this post has taken a long time (and it’s a long post). It’s one of those opinion pieces that moves dangerously between industry comment and personal insight. Add to that a healthy dose of consumer sceptism for banks in general, and you have the ingredients for a tricky piece of writing.

The stuff I’d like to share with you today is around the new online sales platform project at FNB – of which I had some intimate involvement. The project was internally labelled SSA (Single Sales Application), with the word “single” being the operative part. To you, it would just be: getting a bank product online. But getting behind the scenes of what actually changed in this version unravels the bank’s fascinating attempt to push the online sales experience into the new web world.

Current situation for financial applications in the online space? Long, boring, uncreative, repetitive forms with unfriendly language and often ever more work to do post-application than in-application.

What if a bank could produce one sales engine, speaking one customer-centric language, with one design, one set of verification documents and one form to fill in – for any product? Pah! You should have done that years ago, you say. Perhaps.

But you then highlight the thing financial institutes battle with the most with these days. It’s not overcoming legacy, or thinking innovatively about problems... It’s the sky high expectations of the modern Internet user - and meeting those expectations within reasonable time frames across multiple channels (from online, to telephone, to branch, to delivery).

When you buy products online with Amazon, the iTunes Store or even local players like Kalahari, you’re treated to a remarkably simple, intuitive and cunningly cross-sold experience. One click buy. Add to basket. People who like this also liked. Mature and well implemented experiences.

Whether financial institutions like it or not - that experience sets the standard of expectations for customers in the online space.

I could spend 1000 words explaining how process is important and FAIS this, compliance that all rolls together to prevent financial companies from really breaking the mould. But I won’t. Because that’s not the point. And customers don’t care. They want a sales experience that performs alongside the benchmarks, not behind them.

It was with this slightly cavalier attitude that the bank approached the online sales project. Some personal thoughts and insights follow.

Leads, more leads and applications

Let’s start off with the difference between a lead and a sales application, fundamentally different behaviours yet often confused. There are two big factors in play here:

Give us options. South Africa is a young Internet audience, just starting to grow up and really use and trust online services. Some of us might want an automated sales experience. Others don’t have the confidence to proceed from the loneliness of their couch. Always provide a “warm body backup” - a quick call back from a friendly voice goes a long way in this space.

And while you’re doing that? Provide save points and exit points for any level of frustration that may occur. Sometimes we get bored. Sometimes we run out of time. Sometimes our browser crashes. Catch the drop offs wherever possible, or fall victim to a nasty bounce rate and very little explanation as to why!

Never underestimate the power of a lead. If you’ve got a powerful call centre infrastructure and a simple product that escapes reams of compliance paperwork? There’s no reason not to just use a lead form – the local insurance industry is a shining example of how this works.

- 3 to 5 fields.

- Call back within an hour.

- Voice recording for legal acceptance.

- Friendly, well trained call centre agents to whip you through the process.

You can’t beat efficiency. And until the Internet can mimic or improve that experience – don’t bother. But what if you can improve that experience? What if you can create the simple, intuitive, retail interface that customers have come to expect?

Delving behind the scenes of the platform, here are a couple of points where I think FNB is moving in the right direction (and hopefully ahead of the curve)

As many products as you like. At the same time.

The first release of the sales engine opens up Credit Cards, Cheque Accounts, Investment Products and Share Investing Products into the new experience (all other products exist, just in singular application forms).

Believe it or not (and some don’t!) financial products often require vastly different data sets. Not only is your challenge to keep this data down to a minimum but also to only ask for it once. There is nothing more frustrating to a digital citizen than having to fill out the same form twice. Banks can take one to the chin here – they haven’t been too good at that in the past.

So now, you’re allowed to select as many products as you like, and provided one of them is in the above list, you’ll be treated to the new experience. Total screens to get through? Four screens and a couple of pop ups. Total times you’ll have to fill in that info? Once.

That’s STILL more complicated than Amazon. But let’s be fair – giving you R10,000 credit is a whole different ball park to ordering that sweet-smelling air freshener and “What to Expect When Expecting” combo deal.

Some stats from the first month or two reveal usage of this “multi-product” function is on the up. There have been instances of customers selecting up to 14 products at a time (go big or go home?) and it’s been amazing to watch, without any real promotion, 1 in 5 orders on average go through with more than one product attached. The basic human need is for options in the face of complexity. Branches have been servicing this need for a long time. Now the online space can chip in.

All power to the customer in the retail relationship.

There were two big customer experience gaps that I felt where missing in the online financial sales game. Firstly, the whole “add to basket” experience. A lot of confusion, in my opinion, is caused by the complexity of bank products and sales processes.

Sign this. Now this. Now that. Show me this. Oh, you’re missing THAT? Don’t you want this extra? OK! Well sign this. Now that.

You get the point.

If you want a product, or a bank wants to suggest an additional product to you (again, let’s be realistic, banks WANT to cross sell, doesn’t everyone?)... You should be able to get it in one click. End of story.

And then once you’ve built this little basket of financial goodness, you should be able to pull, push, prod and tweak those products as much, or as little as you like.

There is such amazing embedded value in these bank products that no-one knows about. I learnt the other day that in certain cases, I can by an LCD TV with my Platinum Credit Card, walk out the store, drop it – and the thing is fully insured. Giving power back to the customer in terms of setting up his product options and added values goes a long way to getting this message out.

Give it to me quickly. And don’t make me walk into a branch if I don’t want to.

There were a lot of creative phrases tossed around while dreaming up the vision for the sales engine. The one that stuck with me the most was “banking from the comfort of your couch”. It’s nothing new, although I’m constantly surprised that customers don’t know it’s available. Most of FNB’s main products have had courier delivery options for some years now. It really comes down to how you sell it and who actually wants it.

But before the courier comes into play – the speed of your purchase experience holds the key. Here’s how I (a slightly melodramatic marketer to be fair) do the math:

- Drive to branch. 30 minutes.

- Short queue. 10 minutes.

- Application process. 15 to 30 minutes (depending if you brought the right documents in)

- Drive back. 30 minutes.

I exaggerate a little for effect! But it’s a great segway to one of the stats I am proudest to report. It takes about 9 minutes and 30 seconds for the average customer to get from the Product Shop to the Thank You screen.

Call banks old fashioned. Call ‘em inefficient. I think 9 minutes is one helluva achievement. Something I don’t mind yelling from the rooftops.

I could go on for a while, but just wanted to take you guys through some quick insights into step one of the long and involved digital sales journey that the bank has started.

Drop by. Give it a go! Try out the courier option. Better than that? Let me know what you think. It’s becoming increasingly important to involve customers in the product dev cycle. A lesson any web company can give to their bricks-and-mortar brethren. Let’s live it.

The platform been live for a couple of months now, and there are just one or two small issues being ironed out. Mostly around people that have been old customers of FNB and still exist on the database. Trickier issue than you may imagine. How can a bank be sure the YOU that had that Bob account 15 years ago is the same YOU sitting behind the computer? Rather be safe than sorry, eh?

A project of this size (and it’s only going to get bigger as the platform takes on “lending” products like Homeloans and Personal Loans) is never one person’s project. From the online teams to the mainframe wizards, the testers, the product owners, the designers, the coders, the devs, the project managers and everyone who stuck their nose in with a good idea – it’s been an honour. Hope the customers out there feel the same way...

Great article Andy! Extremely interesting :)

ReplyDelete